SO 2+ FABRICATED NOTES OR ONE REAL?

“I think what Judges are missing here is that if a party could not plead or prove a judicial foreclosure they shouldn’t be allowed to proceed in a non-judicial procedure. The question is how to prevent that miscarriage of justice and due process. If disinterested parties who would be sanctioned for bringing the claim in a judicial foreclosure are allowed to proceed as the forecloser in a non-judicial action, we have a very clear procedural and constitutional problem in the application of non-judicial procedures. It converts a convenience for the inevitable and designed for judicial economy to a device for fraud wherein the courts, when they get involved, are made complicit in the fraud. A simple denial, like any in any judicial action, should be sufficient to require the forecloser to either commence judicial foreclosure or go away. At this point, with all the dismissals at trial and all the defaults entered once the borrower gets to the point where the Court allows discovery, it is pretty obvious that these mortgage problems cannot be adequately resolved without strict adherence to the requirements of due process, to wit: pleading and proof.” Neil F Garfield

I was in Federal Court yesterday providing moral and other support to a bankruptcy lawyer on three appeals. The other side made the usual arguments being dismissive of any problems with the foreclosure process and how the Judges should concentrate on the fact that the borrower had not paid — and not whether the payment was due — or whether the right person or company was claiming the payment (or the house)…. when out of the blue the Chief Judge of the BAP panel who frankly did not seem too friendly to the borrower, said ON RECORD something like the following (I’ll get the transcript and insert it later):

“Now hold up a minute. I sit as a presiding Judge in Bankruptcy Court In the State of [deleted] and on multiple occasions I have had on the same docket multiple parties each claiming to be holding the original note and each claiming the right to enforce it and each asking for a motion to lift the automatic stay. ……. [and then the Judge sitting next to him said]

“I sit on the same Bench in the State of [deleted] and I’ve had the same problem many times.”

AN ORIGINAL IS NOT NECESSARILY AUTHENTIC

After the recent revelations from the US Bankruptcy Trustee in another case showing that LPS has been involved in a pattern of conduct constituting systemically fraud in the creation of false “original documents” and after dozens of similar reports from state court Judges around country, I think we can comfortably say that there are three possibilities:

- In each case all of the pretender lenders had an “original note” created by LPS or some similar entity specializing in creating and fabricating false documents (one of which showed up in Virginia where the borrower had signed in black ink and the “original” had her signature in blue ink), and NONE of the “originals” was authentic.

- In each case, ONE of the pretender lenders had the authentic original note and the other pretender lenders had false “original” documents.

- In each case NONE of the pretender lenders had the authentic original note nor any right to have it in their poessession except as an accommodation to the creditor.

You will note that the pretender lenders are usually careful about saying they are the “holder” and not that they are the holder in due course and especially not that they are the owner of the note and never do they say they are the creditor. In short, they are playing words games with Judges who think they understand what is being represented and when the borrower’s attorney points out the discrepancy, the Judge views it as a technical matter that is meant to distract from the simple fact that the poor borrower hasn’t paid his debt —-

When in fact, the distraction has already occurred and a completely disinterested party is going to take the order of the Judge, even if it is just an order lifting the stay and use it in any further proceedings stating that the matter has already beenlitigated and decided against the borrower — despite the fact that there has never been any evidence introduced into the record, nor could there be, since there never was any evidential hearing or discovery.

Show me the note sounds good, but if they DO show it to you, even if your client is ready to admit it, do NOT allow it to be authenticated without being examined.

Do Not Get Hit By Foreclosure - Other

Do Not Get Hit By Foreclosure - Other Rocket Dockets Undermine Faith In Judicial System

Rocket Dockets Undermine Faith In Judicial System New Bank Strategy: There was no securitization - IRS AMNESTY FOR REMICs

New Bank Strategy: There was no securitization - IRS AMNESTY FOR REMICs US Bank Antics versus Their Own Website

US Bank Antics versus Their Own Website Foreclosed Properties in Springfield

Foreclosed Properties in Springfield RESEARCH: This squarely disprove and nullify the holdings of various courts around the country which have taken the position that the borrower "is not a party to" the securitization

RESEARCH: This squarely disprove and nullify the holdings of various courts around the country which have taken the position that the borrower "is not a party to" the securitization A Horrible & Ill-fated Property Foreclosure in This Economy - Home

A Horrible & Ill-fated Property Foreclosure in This Economy - Home Elizabeth Renuart on Non-Judicial Foreclosures

Elizabeth Renuart on Non-Judicial Foreclosures Back to HOLDER and HOLDER IN DUE COURSE

Back to HOLDER and HOLDER IN DUE COURSE The Foreclosure Process in America....Courts Transferring Ownership of America To Foreign Countries and Shadowy Foreign Entities...

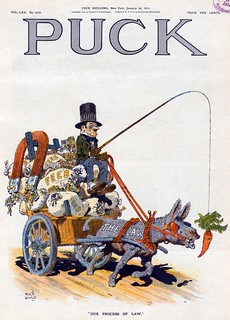

The Foreclosure Process in America....Courts Transferring Ownership of America To Foreign Countries and Shadowy Foreign Entities...

They named MERS as nominee for Commerce.

The assignment simply states that Commerce Bank by way of MERS is now assigning Wells Fargo the mortgage so together with note and mortgage WF can enforce .. etc.

I stated that we never borrowed money from WF, they are trying to take our house now but we have proof showing our note was indorsed to WaMu at the time of the loan. WaMu was packaging and selling off notes to securities before they went under. Wells Fargo has never proved they own the note.

and the Judge says “well yes, what do you mean by authenticated? We’re authenticating it right now, I know thats the real note”. I try to argue that it’s a contradiction of what the attorneys certification shows exhibit “c” as the true and accurate copy, now we have two diferent versions of the note, one is indorsed and one isn’t … but the Judge refuses to accept my argument.

I argue that NJ Appelate Division just reversed a case in January 2011 on the same issue, an affadavit alone by someone who says they read the business records “does not” constitute personal knowledge. The Judge still disagrees with me.

What I learned is that the credit card company will start calling after first month missed. Then more calls and some letters stating we can help, you are two months behind. The window is 6 months. Around the 4 or 5th month they will send a letter offering you a discount. So you can call them and either take the offer or try for bigger discount. Or ignore them all together. Then after 6 months you are sold to a collection company who pays pennies on the dollar. Collection company now sends letters/phone calls and they offer discount as well. But, remember the Credit Card company wrote off the debt from their books or cash flow into some ABS. The debt buyer simply bought something and now hopes you will pay for it. In this case they bought debt. My view is why should I pay for something they bought, I do not owe them money as they did not lend me money. The credit card company got their default insurance so they are whole. The credit card company, which is a business and/or public company now views me as a bad customer so they do not want to do business with me, see it’s all business, and I do not wish to do business with them.

So it is going on 2 years now since I defaulted. I have had several collection companies sell the debt between themselves, each time the amount they pay is less and less. It’s probably down to .001 cents on the dollar. There are a ton of collection companies, and debts are sold in packages. They go for the low hanging fruit and make as much as possible as soon as possible off people who do not know. Calif statue of limitions is 4 years so I have two to go, my credit score is 500. I pay all cash. I bank at credit union. I would switch banks before you default. I also keep some money in the credit union but I keep most cash at my own bank, my home, and I add to it weekly as I earn money.

If at anytime somebody tries to sue me, I file bankruptcy on all of the defaulted cards. I have default on $40k. My wife $100K. Me its been two years, her 1 year. I don’t know, so far nothing.

Funny thing is I get credit card offers in the mail all the time. It’s a numbers game. So there you have our economy 40% is financial. All these companies chasing paper, debits and credits, balancing books, etc.

Dudes of the powers that be, where’s the real products in the “economy”? Every year the real products get less and less and the fake products of money, debts, yields on investment, etc get more and more.

http://screwtapefiles.blogspot.com/2011/02/sample-letters-to-send-to-scumbag-loan.html

Write a debt validation letter please, post at scribd.com, and link it here. Thanks

I’ll do the same with letters for judges.

Wait to link it here for a ‘buzz’ article here.

From what I have seen, judges may issue mandates for their own courtrooms. Judge Grossman did. So have others. Judges can essentially say to the pretenders, “Don’t even think about coming into my courtroom without x, y, and z.”. They can do this because showing up with x, y, and z is actually the law as it is today, right now.

We’re going to have to get there, that is, to be able to articulate our own cases, I think. There just aren’t enough attorneys to go around. (Who’d have ever thought you’d hear that?)

In the meantime, YOU and I need to write every judge in our jurisdictions and tell them what we expect them to do: follow the law. Send them letters, send them anything which appropriately expresses our unhappiness with decisions being made which are not based on an appropriate application of the laws and rules. ” I believe in the proper application of the law and as to foreclosures, I don’t believe this is done in your courtroom. I am not kindle. I am a voter.” Only say this to judges whom you feel have not ruled properly.

We can be our own lobbyists for the cost of a few stamps. The names and addresses of judges can be found at the courts’ websites. Wouldn’t it be great if all courts got thousands of letters in the next week?

We didn’t start the fire – they did.

We were unwittingly used as kindle to burn all but a few. They’d like to keep the fire going. Not.

Wall Street and its cronies plundered and looted and used and abused and have demoralized an entire citizenry. Congratulations, you traitors. We’re going to save our homes and right after that, we want you in jail. Jail first is good, too. We are ultimately going to lose if we don’t all stand up. They will use their clout and any trick they can to see to it. Taking 20 minutes to write a letter, copy it, and mail out copies that our voting voices are heard loud and clear is somewhere to start.

Now.

Let’s write to the judges, write our legislators. No, we dont want to, but it has to be done. Remember, the pen is mightier than the sword, and we are the voters. Do it now! Yes, me and yes, YOU. Post an I wrote the letter.

And if you live in AZ, check out attorney Findson’s website while you’re at it.

What is MERS?

What is a servicer?

How can I find out the identity of my servicer?

Why do I need to know the identity of my servicer?

Where can I get more information on my loan or the basics of obtaining a mortgage?

How do I inform MERS that my personal information is inaccurate on a MERS system?

FAQs On Disputing Your Personal Information

Responding to borrower inquiries

Making advances when required

Accounting for principal and interest

Holding funds for payment of property taxes and hazard insurance (also called Managing your escrow account)

Making any physical inspections of the property

Counseling delinquent mortgagors

Supervising foreclosures and property dispositions in case of defaults

After your mortgage loan closed, your lender more than likely outsourced the job of managing your loan to another company called a SERVICER. This is the company you call when you have questions about your loan.

Access MERS® Servicer ID, a free web-based system.

Before calling or accessing the website above, please have the following information ready:

The borrower’s name and social security number, or

The property address

WHY DO YOU NEED TO KNOW THE IDENTITY OF YOUR SERVICER?

Your Servicer is also responsible for collecting your payment. To avoid late fees and potential fraud, make sure you are sending your payment to the correct Servicer.

If you are unable to make the payments on your mortgage and wish to negotiate the terms of your loan, you may only do so with your Servicer. Contrary to popular belief, it is your Servicer and not the lender that can negotiate the terms of the loan with you.

Perhaps one of your more learned readers would deign to comment on this.

One of the mistakes borrowers are making on their bk petition is listing the da– servicer on the

schedules. List the lender as “unknown” and maybe even disputed. Then make sure you have filed a homestead on your home – you should do this, anyway, before you file bk. Actually, I would do it, bk or not. List the homestead exemption on your schedule. Look up the homestead statutes in your state. It’s easy. Just google

“your state homestead statutes”, or like if you live in Nebraska, say, try ‘NRS homesteads”, or Arizona try ‘ARS homesteads’. Keep googling til you get it. The R is revised and the S stands for statutes. I’m not a lawyer. This is not a substitute for legal advice.