Fitch Affirms Wells Fargo Student Loan Trust's 2001-1 Senior Note

NEW YORK, Apr 29, 2010 (BUSINESS WIRE) -- Fitch Ratings affirms the senior student loan note of Wells Fargo Student Loan Trust (WFSLT) 2001-1, issued under the 2001 Trust Indenture, dated Nov. 1, 2001. The Rating Outlook remains Stable. The trust has sufficient credit enhancement for the senior note with senior parity at 128.64% as of Jan. 31, 2010 and increasing. A complete list of rating actions follows at the end of this release.

Fitch's Global Structured Finance Rating Criteria were used to review the ratings, and the affirmation is based on the performance of the trust in line with the expectations outlined therein. The Outlook remains Stable because, with the buildup of parity for the senior note, the ratings are expected to remain stable for the next two years. The subordinate student loan note will be reviewed separately upon the completion of the updated basis risk analysis.

The collateral supporting the WFSLT 2001-1 notes consists entirely of federally guaranteed student loans originated under the Federal Family Education Loan Program (FFELP). FFELP loans are guaranteed at least 97% of principal and accrued interest, depending on the loan origination date. The loans are serviced by the Wells Fargo Bank South Dakota.

Fitch affirms the ratings with a Stable Outlook on the following senior class of WFSLT's 2001-1 notes, issued under the 2001 Trust Indenture:

--Class 2001-1 A-2 at 'AAA/LS1'; Outlook Stable.

The following applicable criteria report is available on Fitch's web site at 'www.fitchratings.com':

--'Global Structured Finance Rating Criteria' (Sept. 30, 2009).

Additional information is available at 'www.fitchratings.com'.

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK:HTTP://FITCHRATINGS.COM/UNDERSTANDINGCREDITRATINGS. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY'S PUBLIC WEBSITE 'WWW.FITCHRATINGS.COM'. PUBLISHED RATINGS, CRITERIA AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH'S CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE 'CODE OF CONDUCT' SECTION OF THIS SITE.

SOURCE: Fitch Ratings

Fitch Ratings, New York

Jeff Prackup, 212-908-0839

Aoto Kenmochi, 212-908-0867

or

Media Relations:

Sandro Scenga, 212-908-0278

Email: sandro.scenga@fitchratings.com

Bloomberg Takes a First Step at Piercing the Veil of Secrecy Surrounding CDOs

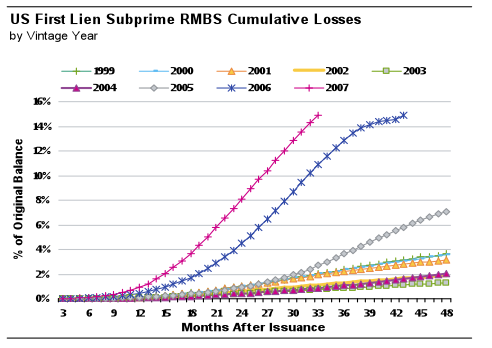

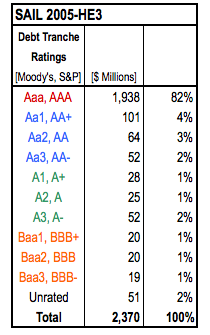

Read More: Aig , AIG Bailout , Bloomberg , Cdos , Credit Rating Agencies , Goldman Sachs , Mortgage Crisis ,Subprime Mortgage Crisis , Subprime Mortgages , Trust Company Of The West , Business NewsA recent Bloomberg story about one of the CDOs insured by AIG, Davis Square Funding III, is a stark reminder of one of the bedrock principles of real estate lending: Timing is everything. Davis Square III, originally underwritten by Goldman Sachs, was comprised of pieces of mortgage bonds issued in 2004, two years before the home prices peaked.As the chart from Moody's demonstrates, when home prices stopped rising in 2006, loan losses soared. So when Davis Square III's investment manager, Trust Company of the West, substituted 2004-vintage bonds with subprime deals issued in 2006 and 2007, AIG got stuck insuring an obligation far more toxic than one it had bargained for. The basic tenet of structured finance--what you see is what you get--seems to have been short-circuited. And the ultimate cost was borne by the taxpayers, who now own a slice of Davis Square III in an AIG bailout vehicle called Maiden Lane III. The asset substitutions may look like a bait-and-switch, but Trust Company of the West, or TCW, had simply exercised the latitude afforded it under the documentation. And Davis Square III is not unique. Davis Square Funding VI, and VII, also underwritten by Goldman and managed by TCW, were also designed to allow for similar asset substitutions.But except for Davis Square III, we don't know whether any asset substitutions occurred. Virtually all CDOs remain shrouded in secrecy. Their financial reports remain hidden from public view, unavailable to anyone except actual CDO investors, who are bound by a non-disclosure agreements. Bloomberg's coup was to pierce that veil of secrecy, and to drill down into the details of one CDO.Credit Ratings and Deep SubordinationIt's easy to see how the Davis Square CDOs seemed like low-risk propositions five years ago. If you only looked at the historical loss rates on subprime mortgages issued prior to 2005, and relied on the underlying bonds' credit ratings, then everything looked fine. In both Davis Square VI andDavis Square VII, the most important portfolio criteria pertained to credit ratings. At least 55% of the investments held by the CDO had to be rated AA- or higher, and none of the investments could be rated below A-.If you are unfamiliar with mortgage bonds, you may not realize that a tranche rated AA- is very deeply subordinated. Subprime mortgage bonds all have pretty much the same capital structure. Anything that isn't rated AAA ranks in the bottom 20% of seniority. Anything rated below AA- ranks in the bottom 10% of seniority. The capital structure of Structured Asset Investment Loan Trust 2005-HE3, or SAIL 2005-HE3, a deal underwritten by Lehman, followed the standard template:

The asset substitutions may look like a bait-and-switch, but Trust Company of the West, or TCW, had simply exercised the latitude afforded it under the documentation. And Davis Square III is not unique. Davis Square Funding VI, and VII, also underwritten by Goldman and managed by TCW, were also designed to allow for similar asset substitutions.But except for Davis Square III, we don't know whether any asset substitutions occurred. Virtually all CDOs remain shrouded in secrecy. Their financial reports remain hidden from public view, unavailable to anyone except actual CDO investors, who are bound by a non-disclosure agreements. Bloomberg's coup was to pierce that veil of secrecy, and to drill down into the details of one CDO.Credit Ratings and Deep SubordinationIt's easy to see how the Davis Square CDOs seemed like low-risk propositions five years ago. If you only looked at the historical loss rates on subprime mortgages issued prior to 2005, and relied on the underlying bonds' credit ratings, then everything looked fine. In both Davis Square VI andDavis Square VII, the most important portfolio criteria pertained to credit ratings. At least 55% of the investments held by the CDO had to be rated AA- or higher, and none of the investments could be rated below A-.If you are unfamiliar with mortgage bonds, you may not realize that a tranche rated AA- is very deeply subordinated. Subprime mortgage bonds all have pretty much the same capital structure. Anything that isn't rated AAA ranks in the bottom 20% of seniority. Anything rated below AA- ranks in the bottom 10% of seniority. The capital structure of Structured Asset Investment Loan Trust 2005-HE3, or SAIL 2005-HE3, a deal underwritten by Lehman, followed the standard template: SAIL 2005-HE3 was a microcosm of the broader market, in that the amount of bonds rated AAA was about six times as large as those rated between AA+ and A-. Consequently, it seems likely that the Davis Square deals were initially stuffed with many subprime tranches rated AAA, which initially improved those portfolios' blended credit ratings.But the AAA tranches get paid down first. And if the underlying home loans are prepaid quickly, the AAA tranches tended to shrink dramatically, thereby affording TCW the flexibility to insert later-vintage AA- tranches into the portfolio. Again, SAIL 2005-HE3 example was typical; 30% of the principal had been prepaid within a year of the deal's initial closing.Why Subprime Borrowers Were So Quick to PrepayBut why would so many homeowners with bad credit who were stretched thin decide to rapidly prepay their mortgages? At that point, they weren't refinancing to take advantage of lower interest rates, and almost all of them faced prepayment penalties. The answer reflects the dirty little secrets of the subprime sector. SAIL was also typical in that about 33% of its mortgages were no doc loans, otherwise aptly named liar loans.After the subprime market began collapsing in 2007, Fitch reviewed a sampling of subprime mortgages with characteristics similar to those held by SAIL 2005-HE3. Fitch found that the vast majority of loans in its sampling were secured by fraud. About 2/3 of the loans involved occupancy fraud. In other words the borrowers claimed the property has their home but lived somewhere else. Almost half of the borrowers falsely claimed to be first-time homebuyers, who, in fact, had held mortgages somewhere else. A slight majority of the loans involved some kind of appraisal fraud. Clearly, a lot of these borrowers were seeking to make quick money by flipping a piece of real estate financed by a lender who didn't ask too many questions. Almost half of the mortgages in the Fitch sampling were in the state with the biggest bubble, California. Of course, none of this was news. Back in 2000, HUD Secretary Andrew Cuomo was alerting everyone that fraud had gone viral in the subprime mortgage sector.Quick prepayments were also prompted by crooked lenders like Ameriquest , which engaged in loan flipping schemes, designed to get borrowers to refinance within two years so the firm could earn upfront fees.Another other dirty little secret of the industry was a euphemism known as "distressed prepayments." If a borrower became delinquent in his monthly payments, he either sold his house and downsized, or covered the deficiency with a larger cash-out mortgage attained with a higher home appraisal. Almost half of all subprime loans were for cash-outs.Flipping schemes and distressed prepayments may have harmed consumers, but they did not cause loan losses so long as home prices kept rising. And home prices continued to rise so long as Alan Greenspan and Wall Street kept up their easy money policies. When home price appreciation stalled in 2006, those flipping schemes and distressed prepayments suddenly became problem loans. That's why mortgage bonds that closed in 2006 performed so much worse than those issued one year earlier.From early 2006 onward, worsening delinquency statistics showed that a lot of subprime investors would get wiped out. But TCW, as the investment manager for the Davis Square CDOs, was not bound by any due diligence standard. Ratings from Moody's and Standard & Poor's were used as a substitute for due diligence. TCW could replace a solid AAA 2004-vintage investment with a toxic AA- tranche of a 2007 subprime deal, in accordance with the discretion afforded TCW under the "structure."The Truth About CDOs Remains HiddenWhatever happened with Davis Square VI or VII or the CDOs underwritten by Goldman and managed by TCW remains a mystery. All of the players tied to subprime CDOs, acted with the expectation that their decisions would never be subjected to public scrutiny. It's high time that the government required all mortgage securitizations, including privately placed CDOs, to disclose all of their monthly performance reports. There is no legitimate business purpose for keeping that information secret.Finally, the investors who reaped billions by betting against CDOs utilized that other financial instrument of secrecy, credit default swaps. Nothing better reflects Wall Street's culture of secrecy that the position taken by The Depository Trust & Clearing Corporation, which operates a clearing house for credit default swaps. Prior to March 23, 2010 the DTCC refused to provide regulators access to specific counterparty information.Related News On Huffington Post:

SAIL 2005-HE3 was a microcosm of the broader market, in that the amount of bonds rated AAA was about six times as large as those rated between AA+ and A-. Consequently, it seems likely that the Davis Square deals were initially stuffed with many subprime tranches rated AAA, which initially improved those portfolios' blended credit ratings.But the AAA tranches get paid down first. And if the underlying home loans are prepaid quickly, the AAA tranches tended to shrink dramatically, thereby affording TCW the flexibility to insert later-vintage AA- tranches into the portfolio. Again, SAIL 2005-HE3 example was typical; 30% of the principal had been prepaid within a year of the deal's initial closing.Why Subprime Borrowers Were So Quick to PrepayBut why would so many homeowners with bad credit who were stretched thin decide to rapidly prepay their mortgages? At that point, they weren't refinancing to take advantage of lower interest rates, and almost all of them faced prepayment penalties. The answer reflects the dirty little secrets of the subprime sector. SAIL was also typical in that about 33% of its mortgages were no doc loans, otherwise aptly named liar loans.After the subprime market began collapsing in 2007, Fitch reviewed a sampling of subprime mortgages with characteristics similar to those held by SAIL 2005-HE3. Fitch found that the vast majority of loans in its sampling were secured by fraud. About 2/3 of the loans involved occupancy fraud. In other words the borrowers claimed the property has their home but lived somewhere else. Almost half of the borrowers falsely claimed to be first-time homebuyers, who, in fact, had held mortgages somewhere else. A slight majority of the loans involved some kind of appraisal fraud. Clearly, a lot of these borrowers were seeking to make quick money by flipping a piece of real estate financed by a lender who didn't ask too many questions. Almost half of the mortgages in the Fitch sampling were in the state with the biggest bubble, California. Of course, none of this was news. Back in 2000, HUD Secretary Andrew Cuomo was alerting everyone that fraud had gone viral in the subprime mortgage sector.Quick prepayments were also prompted by crooked lenders like Ameriquest , which engaged in loan flipping schemes, designed to get borrowers to refinance within two years so the firm could earn upfront fees.Another other dirty little secret of the industry was a euphemism known as "distressed prepayments." If a borrower became delinquent in his monthly payments, he either sold his house and downsized, or covered the deficiency with a larger cash-out mortgage attained with a higher home appraisal. Almost half of all subprime loans were for cash-outs.Flipping schemes and distressed prepayments may have harmed consumers, but they did not cause loan losses so long as home prices kept rising. And home prices continued to rise so long as Alan Greenspan and Wall Street kept up their easy money policies. When home price appreciation stalled in 2006, those flipping schemes and distressed prepayments suddenly became problem loans. That's why mortgage bonds that closed in 2006 performed so much worse than those issued one year earlier.From early 2006 onward, worsening delinquency statistics showed that a lot of subprime investors would get wiped out. But TCW, as the investment manager for the Davis Square CDOs, was not bound by any due diligence standard. Ratings from Moody's and Standard & Poor's were used as a substitute for due diligence. TCW could replace a solid AAA 2004-vintage investment with a toxic AA- tranche of a 2007 subprime deal, in accordance with the discretion afforded TCW under the "structure."The Truth About CDOs Remains HiddenWhatever happened with Davis Square VI or VII or the CDOs underwritten by Goldman and managed by TCW remains a mystery. All of the players tied to subprime CDOs, acted with the expectation that their decisions would never be subjected to public scrutiny. It's high time that the government required all mortgage securitizations, including privately placed CDOs, to disclose all of their monthly performance reports. There is no legitimate business purpose for keeping that information secret.Finally, the investors who reaped billions by betting against CDOs utilized that other financial instrument of secrecy, credit default swaps. Nothing better reflects Wall Street's culture of secrecy that the position taken by The Depository Trust & Clearing Corporation, which operates a clearing house for credit default swaps. Prior to March 23, 2010 the DTCC refused to provide regulators access to specific counterparty information.Related News On Huffington Post:

No comments:

Post a Comment